They talked about us

Use the budgeting function of the software to forecast and monitor your cash flows.

Having an eye on cash and the financial health of your company is crucial. With cash flow forecasts, you can easily adjust cash inflows and outflows.

Different cash flow scenarios

Anticipate cash flows with forecasted revenues and expenses, including estimated amounts from estimates, for informed decision-making and strategic financial management.

Long-term cash flow forecasting

Benefit from extended visibility of your cash flow with a projection of 3 to 12 months, allowing you to anticipate liquidity needs and make better financial decisions.

Utilization of existing data in the software

Optimize your cash flow by using the existing data from invoices and expenses in the software, reducing errors and providing an accurate view of your financial flows.

Cash management features of the management software

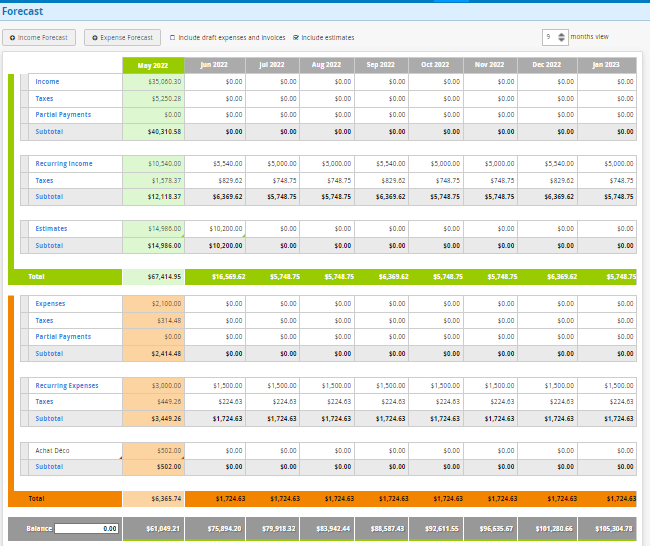

Cash flow budgeting table :

- Visibility up to 12 months.

- Creation of cash flow budgets.

- Presentation of your cash flow table to investors.

- Utilization of data present in the software.

- Automatically generated table.

- Creation of cash flow assumptions

- Monitoring your company’s liquidity.

DO YOU HAVE ANY QUESTIONS ABOUT CASH FLOW MANAGEMENT?

How to create a cash flow budget?

The cash flow function of the software allows you to create a cash flow budget. On one side, you will have the cash inflows:

- Revenues (including revenue taxes and revenue advances)

- Recurring revenues (including recurring revenue taxes)

- Estimates (optional)

And on the other side, you will have the cash outflows:

- Expenses (including expense taxes and expense advances)

- Recurring expenses (including recurring expense taxes)

And ultimately, you will have:

- Cash balances (which correspond to the difference between inflows and outflows)

How to create a cash flow budget?

- Revenues (including revenue taxes and revenue advances)

- Recurring revenues (including recurring revenue taxes)

- Estimates (optional)

And on the other side, you will have the cash outflows:

- Expenses (including expense taxes and expense advances)

- Recurring expenses (including recurring expense taxes)

And ultimately, you will have:

- Cash balances (which correspond to the difference between inflows and outflows)

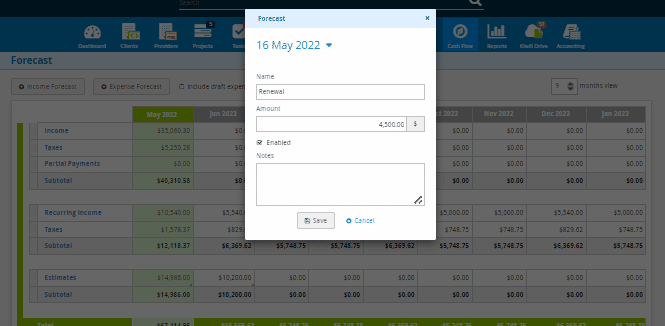

Are estimates included in the cash flow calculation?

In traditional cash flow calculations, estimates are not included. However, in the Kiwili cash flow management software, you have an option to include the amount of estimatesin your cash flow.

Indeed, it is not money that your client legally owes you 100% because there is no invoice, but it is money that will potentially enter your company in the near future. Therefore, it can be useful to have both perspectives of cash flow, with and without estimates.

How to choose budgeting software?

The best budgeting software is the one that saves you time. In Kiwili, all your information is already present (invoices, estimates, expenses), so you can directly consult your budgeting table whenever you want to forecast your cash flows.

What is the role of cash flow management?

The role of cash flow management is to forecast future cash flows. For your cash flow calculation, the software will take into account all the information related to your invoices (with their payment dates) as well as your expenses (with their payment dates). You will have a view of your cash inflows and outflows for the coming months.

What is the primary tool for cash flow management?

The best ally for managing your cash flows is to have the cash flow feature included in your invoice and expense management software. This way, you won’t be doing duplicate work. All the information is centralized in one place, and your cash balances are calculated automatically.

Simplify your cash flow analysis today

14 day free trial No credit card required All our features