Simplified accounting, easy financial tracking

Optimize the financial management of your SME with our online accounting software, making it easy to track your financial activities and automate your accounting process.

They talked about us

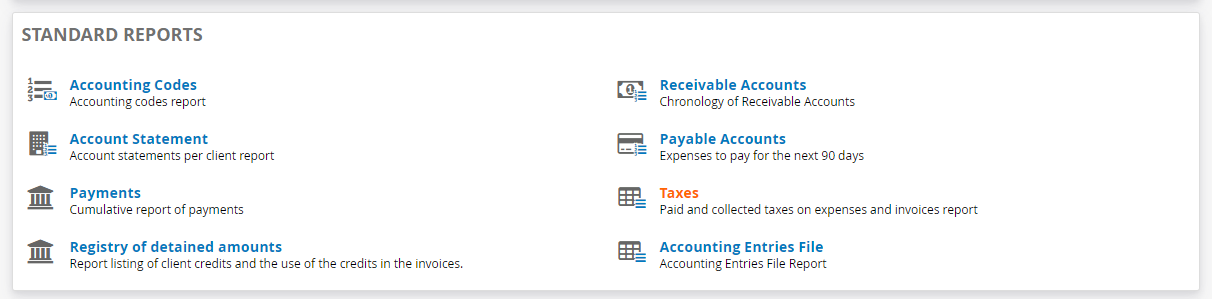

Automate Financial and Accounting Reports: Simplify your data analysis with our software.

With all the data you enter during invoice creation, expenses, payments, etc., the software automatically generates financial and accounting reports.

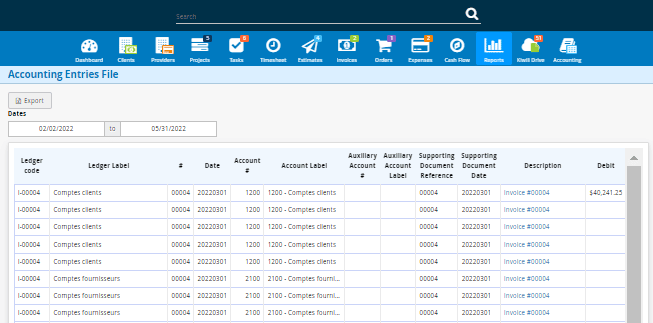

One-Click Creation of Accounting Entries File

Simplify your accounting tasks with our software that instantly and automatically generates an accounting entries file.

Essential Financial and Accounting Reports

For SMEs, accessing financial reports through software is crucial to monitor key performance indicators and anticipate financial challenges.

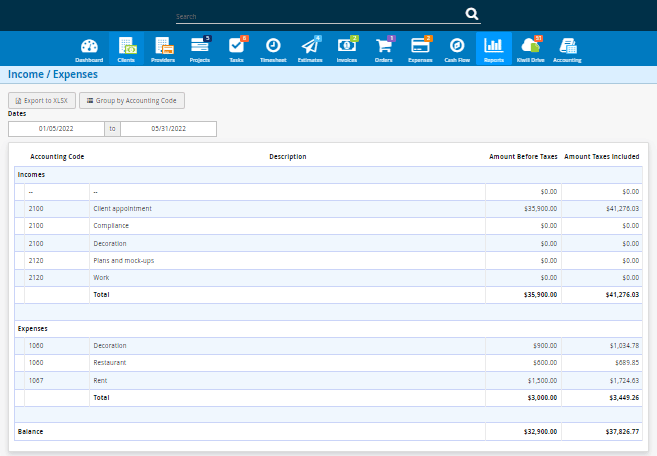

Automate Online Tax Reporting

Facilitate your financial management with our automatic online tax reporting software, allowing you to focus on your core activities.

Financial and Accounting Tracking Features of the Management Software

Financial Tracking for Entrepreneurs:

- Provide your accountant with all the information needed simply and quickly.

- Tax Reports

- Accounting Entries Files

- List of your Revenues/Expenses

- Payments

- Invoice Amounts

- Accounts Receivable

- Accounts Payable

Financial Tracking for SMEs:

Always have access to the complete financial flow tracking of your company.

- Where do your revenues come from?

- What are your expenses?

- How much do you owe to the government?

- Who owes you money?

- Which companies do you need to pay?

- What financial reports do I need?

- How to manage the finances of my company?

- How to manage the accounts of a company?

DO YOU HAVE QUESTIONS ABOUT FINANCIAL AND ACCOUNTING TRACKING?

How to create a FEC file for the accounting of your SME?

The accounting entries file of your company is automatically generated in the accounting software. At the bottom of your indicators, you have a list of financial reports titled “What your accountant needs.” Simply click on it, then choose the dates. You will have all the necessary information in your accounting entries file.

How to create a FEC file for the accounting of your SME?

The accounting entries file of your company is automatically generated in the accounting software. At the bottom of your indicators, you have a list of financial reports titled “What your accountant needs.” Simply click on it, then choose the dates. You will have all the necessary information in your accounting entries file.

How to generate a tax report in the online accounting software?

Every time you create an invoice, an expense, or a journal entry, the accounting software will automatically calculate the taxes. Then, you simply need to go to the list of reports and choose your tax report. Inside, you will find the list of taxes to collect and to issue.

How to manage accounts payable and accounts receivable online?

Managing online accounting can be very simple if you use an intuitive platform. With Kiwili, reports of accounts payable and accounts receivable are automatically generated based on your invoices or expenses. This way, all the information is centralized and organized.

To learn more about accounting management options for accounts payable or accounts receivable, follow our tutorials.

What documents does your accountant need for your accounting?

Many SMEs use the services of an accountant, whether external or internal to your company, they need information and documents related to the accounting of your company. All Kiwili software packages have access to the most commonly used financial and accounting tracking documents, such as invoice reports, detailed expenses, payments, revenues and expenses, tax reports, but above all, the accounting entries file.

If you want to go further in managing your SME’s accounting, you can opt for the ACCOUNTING+ option, which allows you to create balance sheets, trial balances, bank reconciliation, general ledger, journal of accounting entries, and more.

What are the financial flows in a company?

There are four main types of financial flows in a company: investment and operating flows that arise from the company’s activities, as well as equity and debt flows that are related to financing. You can track and manage all financial flows with the valuable tools of your Kiwili accounting software.

Simplify your company’s financial tracking today

14 days free trial No credit card required All our features