Bank reconciliation: at first glance, it sounds complicated, but don’t let the name put you off! This essential process is simply used to ensure that the company’s account books are in line with the business bank statements. In other words, ensuring that the bank account’s debit balance equals its credit balance. Today, we’ll look at why you should carry out bank reconciliation, whether you’re self-employed or a small business, and how to go about the bank reconciliation process.

Why is Carrying Out Bank Reconciliation Necessary?

Bank reconciliation isn’t mandatory by law, but it is used to verify the consistency of the accounts data and to ensure that business owners have a good understanding of their position financially. Knowing where you stand financially is essential for good planning and decision making. More specifically, bank reconciliation is useful for checking whether any data has been omitted and if there are any discrepancies or possible mistakes.

Watch out for these common errors:

- Transactions recorded on the bank statement, but not yet recorded in the company’s books

- Transactions recorded in the company’s books, but not yet recorded by the bank

- Transactions recorded, but with incorrect amounts

- Transactions recorded under debit rather than credit

If these types of mistakes go unnoticed, you could end up paying more tax than you need to. So, once again, bank reconciliation is the process of ensuring the information in your accounting records matches up with the transactions made in your bank account. Imagine purchasing a plane ticket as a business expense on your company card. It will automatically come up on your bank statement, right? Only now you need to record it in your accounting books. If you forget (and you’re only human!), your books will show different figures from your bank account. This process of bank reconciliation, matching up transactions between your accounting records and bank statements line by line, is essential for making sure everything adds up and that there isn’t any suspicious activity.

If you are logging transactions in your books manually, it’s possible you might miss one someday, or make a simple typo. In missing an entry, or missing a digit and entering a lower value, the tax office might think you’re under-reporting your sales in an attempt to pay less tax than you should. This could lead to an investigation from the tax office, which even if you get it all cleared up, is still a tedious and time-consuming process better avoided.

Similarly, if you mistakenly duplicate entries or perhaps count the same transaction twice, you’ll end up paying more tax than you need to. Although it is possible to rectify this type of mistake, it’s again a time-consuming and paperwork heavy process and as a result you could incur fines or administration fees for making these changes.

How To Carry Out Bank Reconciliation

Manually

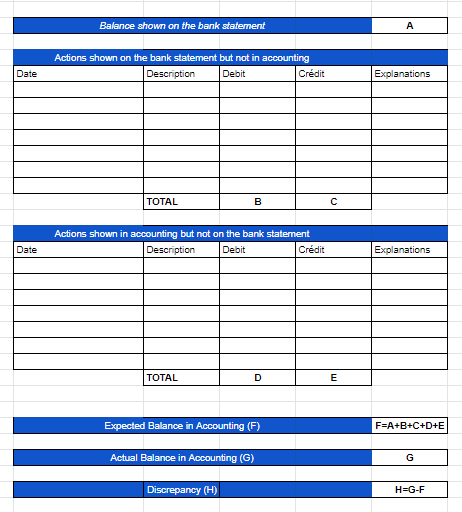

Bank reconciliation can be carried out using an Excel table. You can create by yourself what’s called a bank reconciliation statement, in other words, a table which sums up the corrections to be made to bring the balances back in line with each other.

Here is an example of a bank reconciliation statement:

Note, however, that this method can prove to be hard work.

Electronically

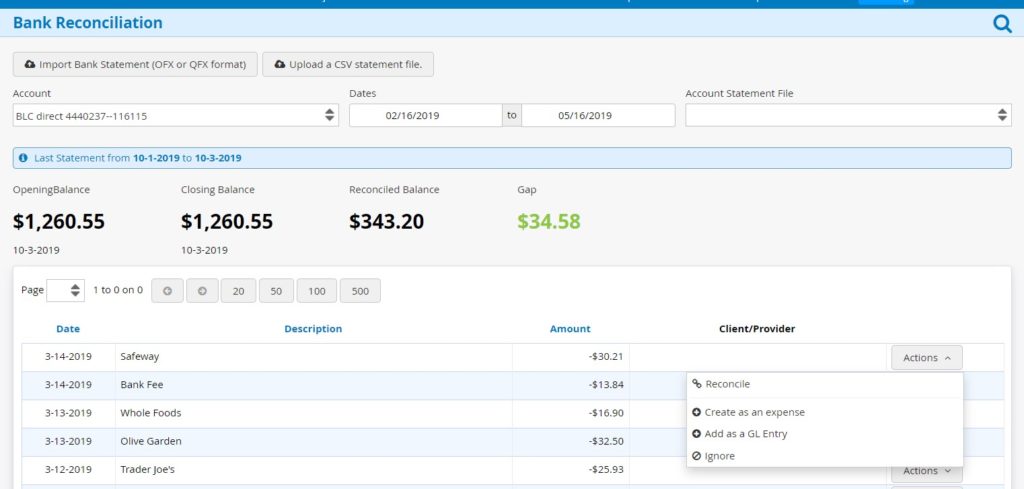

Spreadsheets are a great place to start, but the functionality of cloud-based accounting software like Kiwili is far more comprehensive and greatly reduces human error. If you, like most of us, already have a lot on your plate, and quite simply wish to avoid the trials and tribulations of the bank reconciliation process, the simplest way of doing things is to try out bookkeeping and accounting software like Kiwili. With inbuilt bank reconciliation functionality, all you have to do is import your bank statements and verify line by line whether the transactions logged have been well-recorded in the general journal and then flag up any mistakes.

Note that in double-entry accounting (accrual accounting), used by a majority of businesses, transactions are recorded in the accounting records as they occur or when invoices are issued. Accrual accounting doesn’t take into consideration the payment date.

How Often Should Bank Reconciliation Be Carried Out?

Typically, companies will carry out a bank reconciliation process every month, using their monthly bank statement. Given that most companies, whatever their size, now do their banking online, this means that we very rarely have to enter the accounts data manually, and can simply import the bank statements we receive automatically from our bank by email or download them from our online banking ready to import them into a bookkeeping and accounting software like Kiwili. This process can even be carried out weekly, daily, or simply every time you receive a bank statement if you really want to keep on top of things. This could be in your interest if your business has a particularly large number of transactions and lots of incoming and outgoing funds to keep track of. It’s important to get your bank reconciliation done in plenty of time before rounding up for the end of the financial year.

TO SUMMARIZE..

These days, online software can make most things in life quicker and easier, but especially all things bookkeeping and accounting. The time saved in importing existing bank statements instead of inputting transactions manually means you can instantly start the reconciliation process without a hitch.

Try out Kiwili’s online bookkeeping and accounting software today in order to get everything from your bookkeeping to bank reconciliation done quickly and efficiently. Decrease your margin of error by quickly identifying errors such as double or missed payments and miscalculations, and quickly pick up on suspicious activity such as fraudulent transactions or theft by keeping a close eye on your accounts. Whether you’re just starting out in business/corporate accounting, or you’re just checking in to brush up on your skills, don’t hesitate to check out our other posts covering bookkeeping, accounting and more.

Sign up for Kiwili today for the best all-in-one management software for entrepreneurs and SME’s, and simplify the day-to-day management of your business.

Kiwili is an all-in-one business management software. It is at the same time an easy invoicing software, an accounting software, a CRM, a convenient project management tool and a time tracking software. Everything you need to manage your business like a pro!